A path towards more fairness in compensation strategies?

Since the “Loi Sapin II”’ came in force in March 2017, a major change in France on the "Say on Pay" has been introduced, with an even stricter framework for executive compensation than the EU Shareholders’ Rights directive. During the 2017 annual general meetings in France (SBF 120 companies), 88% of the compensation policies were approv…

Since the “Loi Sapin II”’ came in force in March 2017, a major change in France on the “Say on Pay” has been introduced, with an even stricter framework for executive compensation than the EU Shareholders’ Rights directive.

During the 2017 annual general meetings in France (SBF 120 companies), 88% of the compensation policies were approved by shareholders. This figure is close to the proportion observed the year before for non-binding votes and does not show any significant impact of the “Loi Sapin II” on the approval or not of the compensation packages. However, it sheds light on corporate governance and compensation policies, underlining how shareholders can put executives under pressure.

Beyond the consequences of this law – with a growing number of resolutions on the executive compensation – it generates a redistribution of roles in favour of shareholders and to the detriment of compensation committees, particularly in non-controlled companies.

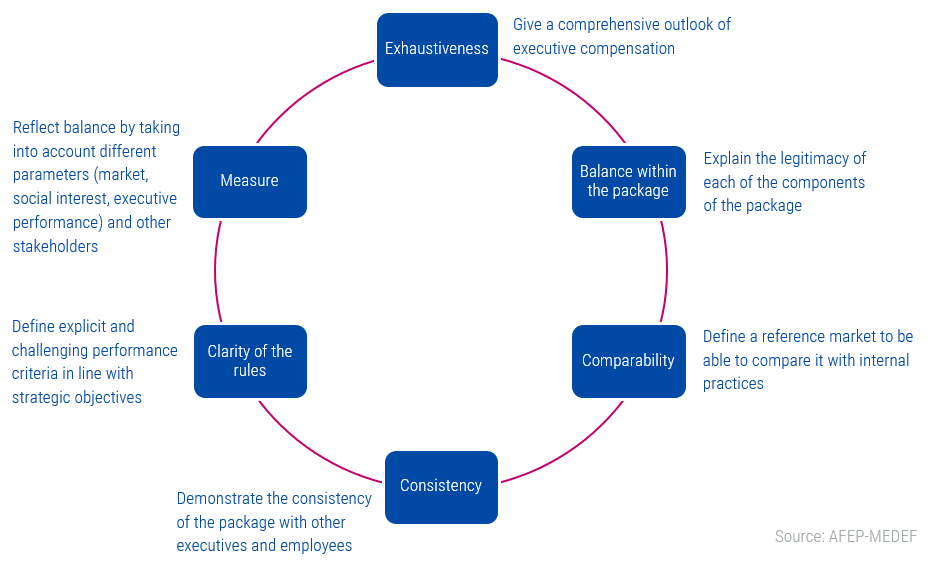

The objective is not only to be transparent regarding executive compensation, but rather to build a consistent, comprehensive compensation strategy. The six principles defined by the AFEP-MEDEF code (see chart below) can be helpful for companies willing to explain their compensation policy (for executives and employees).

“Say on Pay”: make way for more consistent compensation policies

The shareholders and investors wish for more consistency between the compensation and incentive tools and the performance of the company, but they also expect balance within the whole ecosystem of the company. This need for consistency opens a debate on the relevance of the objectives given to executives and their incentive plan in relation to the creation of value in the long term, on the choice of the performance indicators and on how to measure them.

This “Say on Pay” coming into effect with the “Loi Sapin II” reinforces the power of large investors and proxy advisors on compensation policies. The current annual general meetings will be particularly insightful, with a fully in force “Say on Pay” (including an ex-post vote) and the way investors use this tool in their relationship with the company to evaluate the link between the performance of the company and the compensation of its executives.

According to our study of the 2016 annual reports of SBF 120 companies (Source: Kienbaum/Essere 2016-2017 Executive Compensation Guide of SBF 120 companies), a growing number of companies take into account extra-financial criteria to increase the fairness of compensations within the company:

- 20% of companies choose criteria linked with corporate social responsibility the variable compensation of their directors

- pluriannual variable compensation schemes are increasing, even though they are still a minority (10% of companies)

- 14% of companies have set up performance share plans.

Will “Say on Pay” prelude a greater consistency of executive compensation strategies with that of other employees?A new trend seems to unfold, with more fairness between the compensations of company officers, executives and employees of a company, with the goal of increasing the performance of the company in the long term in order to create more value for shareholders.